Who This Course Is For

Training auditors aspiring to work in Transaction Services, Financial analysts, CFO, Business analysts, FP&A managers, M&A consultants professionals, aspiring consultants and Private Equity investors.

Struggling With Financial Due Diligence Analysis? You May Have Faced Being:

Unfamiliar with financial due diligence.

A student or analyst who feel limited when it comes to doing a proper financial analysis of a company and drawing useful insights.

Already familiar with accounting and want to get more analytical in your job.

A person who understands finance but gets lost with advanced accounting.

Lost on what to look at when confronted with heaps of data and information.

Confused on how to best present financials and tell the story behind the numbers.

What you’ll learn and get from this course?

1 - Understand how a Financial Due Diligence engagement is prepared and structured in the Big 4

2 - Understand the methodology of how to conduct thorough financial analysis and what is important in Financial Due Diligence in particular

3 - Have a comprehensive set of analysis that you can apply to each new company that you review, be it as a consultant or internal financial analyst.

4 - Get a complete analysis template to save you time and guide you in all your future engagements

5 - If you’re looking into a career in corporate finance / financial due diligence / private equity, you’ll get a solid foundation that will be a sure asset to land the type of job you’re after.

You have 48 hours to ask for a refund

As long as you haven't watched more than 50% of the training course, if you ask for a refund within 48 hours we will give you your money back right-away!

Improved Job Opportunities

By completing this training and course, you will be strongly armed to analyze the P&L of any company and to be able to provide insightful reports.

You should also be well prepared to get a job in Transaction Services in one of the big 4 or in a Transaction Services boutique, to be a better Private Equity professional or M&A associate, and to have a wider set of tool as a finance manager to help drive strategic financial decision making.

Areas covered in this course

Throughout the 70 videos included in this course you will learn about the purpose of due diligence and how big 4 accounting firms approach and structure a Financial Due Diligence engagement.

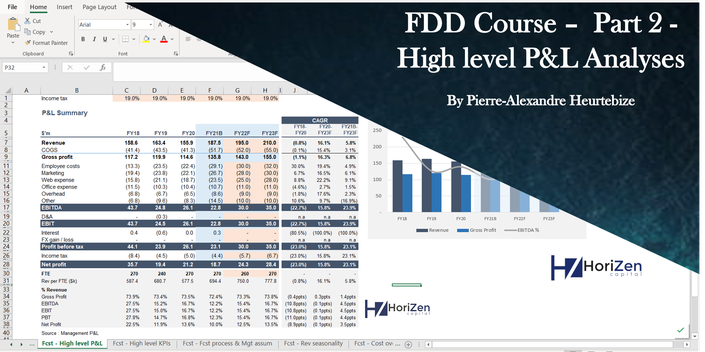

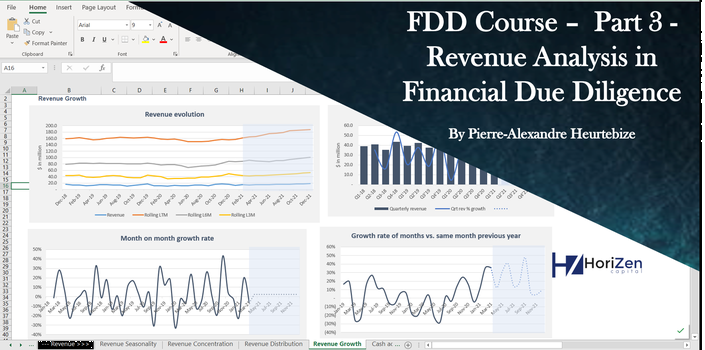

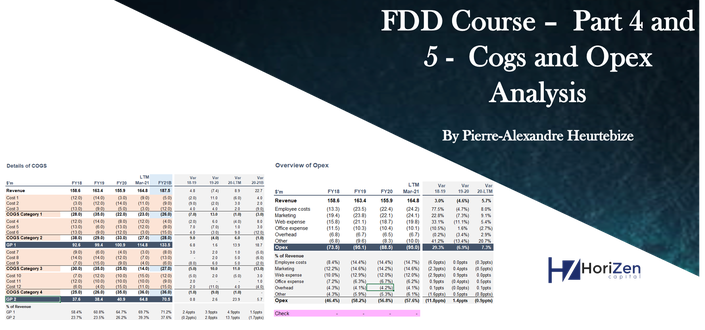

You will then learn a wide set of P&L financial analysis, starting with high-level trends and then breaking down Revenue, COGS, Opex and below EBITDA items.

You will also learn how to do a proper Quality of Earnings analysis and how to review budget and forecast prepared by Management.

The course is based on a full FDD excel template included in the material provided and each section of the courses includes a video and written explanation about the subject covered.

For a complete overview of the cost structure, please refer to the detailed Curriculum below!

Solve Real Life Scenarios

Each videos in our courses will walk the students through one specific analysis, logically following the common structure of financial statements.

Avoid Costly Mistakes

Courses like these teach you to spot important analysis points that can be very costly if overlooked or mis-understood - and can cost millions of dollars for an organization.

Get the Job That You Want

If you’re looking into a career in corporate finance / financial due diligence / private equity, you’ll get a solid foundation that will be a sure asset to land the type of job you’re after.

Course Content Overview

P&L Course Curriculum

- Section 1 - Welcome to the Course & files to download

- Section 2 - When do we need DD (2:25)

- Section 3 - What is the purpose of DD (7:59)

- Section 4 - What are the main goals of a FDD (5:07)

- Section 5 - What a Financial DD is not (9:37)

- Section 6 - What are the big types of projects of a FDD team (9:24)

- Section 7 - Who will use the FDD report (4:02)

- Section 8 - Overview of DD processes (4:16)

- Section 9 - Assignment details - Pre Assignment & Information Gathering (7:57)

- Section 9 - Assignment details - Exploratory Analysis & First Management Q&A (13:28)

- Section 9 - Assignment details - Advanced Analysis and report structuring & Additional Management Q&A (4:01)

- Section 9 - Assignment details - Report Writing & Gathering of findings from other engagement streams (8:37)

- Section 9 - Assignment details - Completion of Report and Partner review & Final draft and client’s feedback (3:45)

- Introduction

- Section 1 - General principles to follow (12:01)

- Section 2 - P&L structure (2:05)

- Section 3 - Overview of P&L analysis in DD (9:46)

- Section 4 - Bridges overview (7:40)

- Section 5 - CYT and outturn (6:50)

- Section 6 - Budget accuracy (6:40)

- Section 7 - P&L by nature vs by function (5:08)

- Section 8 - Constant Currency Analysis (8:07)

- Section 9 - Translation vs transaction effect (6:31)

- Section 10 - Hedging (4:38)

- Introduction to Revenue Analysis in Due Diligence

- Section 1 - Revenue Seasonality (3:34)

- Section 2 - Revenue Concentration (5:58)

- Section 3 - Revenue Growth (9:49)

- Section 4 - Revenue Recognition and cut-off methodology (11:25)

- Section 5 - Revenue and Rebates (9:25)

- Section 6 - Price Volume Mix analysis (9:25)

- Section 7 - Retention - Churn rate (9:10)

- Section 8 - Retention Cohort (5:58)

- Section 9 - Retention By Vintage (8:27)

- Section 10 - Revenue Ramp up (8:26)

- Section 11 - Retention Like for Like (4:31)

- Section 12 - Retention One off vs recurring (8:41)

- Section 13 - Pipeline & backlog (11:57)

- Section 14 - Contract renewal date (3:29)

- Section 15 - Average Revenue per Client - ARPU (7:16)

- Section 16 - LTV per customer (6:57)

- Section 17 - Price Elasticity (3:13)

- Recap : (22:20)

- Introduction to Opex Analysis (2:29)

- Section 1- Fixed vs. Variable Costs Analysis & Sensitivity (9:01)

- Section 2 - A - Organigram & Breakdown of employee costs (3:39)

- Section 2 - B - FTE and Costs per department (5:22)

- Section 2 - C - Analysis of bonus schemes (5:32)

- Section 2 - D - Staff turnover / longevity (10:59)

- Section 2 - E - Revenue per FTE (5:26)

- Section 3 - Rent (4:46)

- Section 4 - Marketing (6:59)

- Section 5 - Other OPEX (3:11)

- Section 6 - Below EBITDA Items (5:36)

- Section 7 - Intercompany (interco) (4:22)

- Section 1 - Quality of Earnings and its importance in a deal (7:26)

- Section 2 - How to organize your QofE (13:50)

- Section 3 - Overall guidelines for QofE (12:16)

- Section 4 - Most common QofE items - 1 to 11 (13:25)

- Section 4 - Most common QofE items - 12 to 19 (14:54)

- Section 4 - Most common QofE items - 20 to 25 (12:05)

- Section 4 - Most common QofE items - 26 to 33 (18:10)

Meet your teacher, Pierre Alexandre Heurtebize

Pierre has graduated from ESSEC, one of the top business schools worldwide, with a specialty in finance. Pierre has over 8 years of experience in financial analysis, gained as a Private Equity Associate, a PwC consultant in Transaction Services and as investment & M&A director at HoriZen Capital.

Pierre is also one of the top financial model authors on Eloquens where his templates are bought and used by several hundreds of finance professionals.

Pierre regularly writes articles about finance, Due Diligence training and Investment. You can read some of his articles on Techcrunch, Toptal or on his Medium page

Testimonial

The Financial Due Diligence training course is amazing!

It is an excellent resource for individuals to get a deeper understanding of financial analysis and due diligence to prepare them for a career within finance or simply expand their knowledge.

A few months ago, I didn't have a clue of how to conduct thorough due diligence and how to complete financial analysis the CORRECT way. Gathering monthly/yearly revenue figures and putting them into a chart without really understanding the fluctuations in detail was something I used to do and call it a day.

This beginner-friendly courses and training dove into everything you need to know to help you understand how a business operates financially and how to examine key metrics. From a top-down approach to breaking down P&L statements, COGS, expenses, and other line items, I am far more comfortable/quicker at conducting due diligence and financial analysis.

Furthermore, this training course helped me land an internship at a boutique Investment Bank, and my first week of training consisted of many of the analyses and due diligence taught in this course and training! Also, speaking about financial due diligence in detail during interviews is also extremely helpful knowing I've had the practice and knowledge from this course and training.

Overall, I highly recommend this course and training to any individual looking to learn more or for a student seeking to break into their dream job. The price is worth the valuable content and training resources to put you in a position to be well equipped in financial due diligence. Incredible work creating the training courses, Pierre and I can't thank you enough!

Pavan B.

Not ready to take the full training course yet?

The course is divided in 7 sections and we've made it possible to buy each section individually.

All the training videos and written content of the sub-sections are included, however the Excel Financial Due Diligence template is only included in the purchase of the Full P&L FDD course.